What does remittance mean?

The word remittance means sending money for a specific purpose or as a gift to another person. However, nowadays, the term mainly describes sending money by someone working abroad to their family or friends in their home country.

The term comes from the expression remit, which means to send back.

Understanding Remittance

Foreign workers make up the greatest number of remittance senders. They also represent the largest value of funds sent to family members and friends in their home countries. One of the most popular new ways of making a remittance transaction is using a mobile money transfer service such as Rocket Remit.

Now, this is important…

– Remittance is money sent from one person to another person, from one country to another one.

– The sender is often a foreign worker or migrant and the recipient a relative back home.

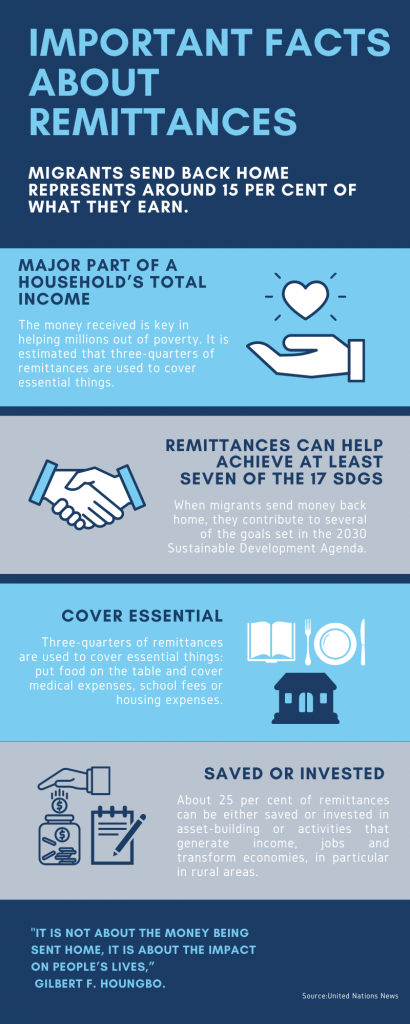

– Remittances represent one of the highest income sources for people in low-income and developing countries.

Remittance means more than just money!

Spending on remittances can generate jobs. Most studies suggest that each $1 in remittances generates a $2–$3 increase in GDP. Recipients buy goods or invest in housing, education, or health care, improving the lives of non-migrants via the multiplier effects of remittance spending.

(Taylor and Martin, 2001)

Remittances are one of the primary motivations for migration. The scale, volume sent and faster speed of remitting has increased global remittance flows dramatically in recent decades. Each immigrant usually has a personal story and it is those stories that motivate them to continue working and supporting their families.

The reasons for sending remittances may vary but are usually for helping family or an individual. This may include financially supporting an ageing parent to maintain their sense of human dignity or making sure a brother or sister finishes school or college. It could be guaranteeing that a sick relative receives medicine and treatment, or to help a friend to start the business they have always dreamed of.

Some countries require remittance to sustain their economies and even offer additional financial incentives for remittance. This means that money naturally flows from wealthier countries to poorer countries. Check our previous blog to learn why are remittances essential for the global economy?

Remittance lingo

ATM Deposit:

An ATM Deposit is the action of depositing money into an Automatic Teller Machine. Depending on the type of ATM, you can deposit cash, coins or cheques into a bank account even when the bank branch is closed. An ATM Deposit is one of many methods for making a deposit and loading your remittance account.

AML/CTF Act:

Australia’s primary AML/CTF law is the Anti-Money Laundering and Counter-Terrorism Financing Act AML/CTF. The main objective of the laws are to help identify and deter money laundering and terrorism financing. AML/CTF laws also provide financial intelligence to revenue and law enforcement agencies.

Bank Transfer:

A Bank Transfer is when a person instructs their bank to transfer money directly into another bank account. This can be done online or via a banking app or even in a bank branch. For remittances, it is one method to load your account and send money abroad.

Compliance:

Compliance is the general name given to observing the rules and regulations as outlined in the law for a particular area. For remittance, Compliance usually refers to the AML/CTF Act as mentioned above. Compliance helps to detect and prevent criminal activity and protect the security and privacy of customers. Compliance is vital for detecting and preventing money laundering and other criminal activities associated with remittance.

Corridors:

For remittances, the term ‘country corridor’ or ‘payment corridor’ or just “corridor” is used to describe the two countries between which the remittance occurs. For example, if a person is sending money from Australia to the Philippines, the “corridor” is between Australia and the Philippines. However, because we usually live in a sending country, “corridor” often means only the destination country or the country which is receiving the remittance.

FX Rates:

The FX rate or Foreign Exchange Rate is the comparative value between two particular currencies. It is a measure of the value of one country’s currency versus that of another country. In remittance, the FX Rate determines how much the person will receive in the receiving country.

Exchange rates vary due to numerous global economic factors mainly beyond our control. Even those who transfer money abroad regularly may have difficulty understanding how exchange rates work. Click here to read our blog and read about other Australian money exchange methods.

Fee:

The Fee is the additional amount that is paid for making a money transfer. Each country may have different fees. This may be due to many different reasons such as government policies. For example a government may prohibit the charging of fees on some remittance transfers.

KYC:

KYC means Know Your Customer or know your client. It is the name used for the process of identifying and verifying a customers identity. KYC may require a customer to provide personal information to prove their identity when opening an account such as a drivers licence, bank statement or passport. Some KYC can be done electronically online but some may require the customer to send physical documents.

Mobile Money:

Mobile Money has become the new alternative way of making electronic payments in developing countries. It is very popular in lower-income countries, especially where a bank account can be expensive or difficult to open. Mobile Money can be used anywhere where there is mobile phone network coverage. It makes sending and receiving money faster, cheaper, more efficient and reliable.

Money Laundering:

Money Laundering is the illegal process of moving money produced by criminal activity. I n other words the money is “laundered” or “washed” by making it hard to track.

This could be done by moving it around between many people, spending it in businesses, and sometimes moving it around the world. Consequently breaking money into smaller amounts also makes it harder for authorities to track.

Money Laundering is usually used to hide illegal activity for example: such as financing, terrorism, human trafficking, tax evasion, drug trafficking etc.

Sender:

The Sender is the person who is transferring or sending money abroad. Money is usually from salary, investment income or may even be from a pension. The Sender is the person with family or friends overseas or who simply has a reason for sending money to another country.

Scams:

Online criminals can target vulnerable people in Australia and convince them to send them money abroad. Scammers take advantage and attempt to find weak points in your online activities (including electronic fund transfers). Because more and more people are using the Internet for everyday activities, the number of Scams in the world is increasing. Click here for more information and assistance to help you to recognise and avoid scams.

In September 2015, the United Nations General Assembly adopted the 2030

Agenda for Sustainable Development that includes

17 Sustainable Development Goals (SDGs).

About Rocket Remit

Rocket Remit is the worlds fastest international money transfer service. Send money instantly to over 40 overseas countries at very competitive rates.

Use the country selector to choose the country and check the rate.

Click here for more information on how to send money using Rocket Remit.