The Aussie Slang You Need to Know

Learning Australian Slang or Aussie English is essential for anyone thinking about moving to Australia for an extended period. Leaning Aussie Slang can make integration more comfortable, help you to sound more natural and also assists to better understand Australian people and the culture.

Australians are unique in their everyday conversations, with their expressions and even their jokes. Some people consider it part of their national identity. If you have decided to move Down Under, you don’t want to be lost in conversation or missing any of the Australian jokes!

When Down Under, do as the Down Under do! I have prepared this blog with the help of an expert to help you expand your knowledge of Aussie slang.

Aussie Slang and Expressions

Let’s look at some words and expressions and see if you already know them or use them in your daily conversations. You know you’re becoming an Aussie when you find yourself shortening words.

Ace!

If something is Ace, it means it’s excellent. It’s awesome. It is really, really good. For example, I love going to my local gym to work out because it is “ace”. I recently got a new car and it is an absolute “ace”. It’s excellent. It’s brilliant. It is an awesome car. It’s “ace”

Aerial ping pong

Australian Rules Football or AFL is played and that is nicknamed “aerial ping pong”. Ping pong is another name for table tennis. You know that game where you have a table that has four quadrants and a net and you have these little wooden bats and I guess it’s a plastic ball filled with air and you hit the ball from one side to the other.

People for whatever reason have likened Australian Rules Football to Ping pong because the ball obviously goes all over the place in the air. So, it’s called ping pong. It’s “aerial ping pong” because the ball is in the air.

At Sparrow’s Fart

You might see garden sparrows around pretty much everywhere in suburbia. If you do something “At Sparrow’s Fart”, you do this really early in the morning – at dawn. It means you get up early in the morning – at dawn, right as the sun is rising.

If you’re an early riser, you know you like waking up early in the morning, someone might ask you, “Pete, what time do you get up each day?” And you might say, “Oh, man. Well, I work as a brickie, a bricklayer. And so, I have to get up at sparrow’s fart every single morning, head over to the work site and start working hard at Sparrow’s Fart.”

Aggro

Another Aussie slang word is “aggro”. If someone is “aggro”, they are aggressive, right. So, they are likely to snap at you. They are likely to intimidate you, to come at you, whether it’s violently aggressive, maybe verbally aggressive – they’re a little bit “aggro”.

So, maybe as an example, I’m driving from Geelong to Melbourne. I’m on the Princes Freeway, well, Princes Highway, I think between Geelong and Melbourne, I’m driving along that. I accidentally cut some one-off. That person may be a bit frustrated, angry. They’re “aggro”.

Barbie

Pretty common Aussie slang is ‘a barbie’ (a barbecue). Now, it can be both the utensil, the thing on which you cook things like snags, which are sausages, or prawns or burgers or steak or chicken, could be anything. You know, usually meat. It can be that tool that you use. Sometimes gas-powered, sometimes powered by coal or by wood.

But ‘a barbie’ can also be the event of a barbecue. So, I might be cooking some meat on the barbie, but I might invite my friends to come over to a barbie.

So, it can be both the machine, the utensil, that you cook things on, but it can also be the event, right? Like a lunch, a dinner, some sort of party that you’re having. That is also ‘a barbie’.

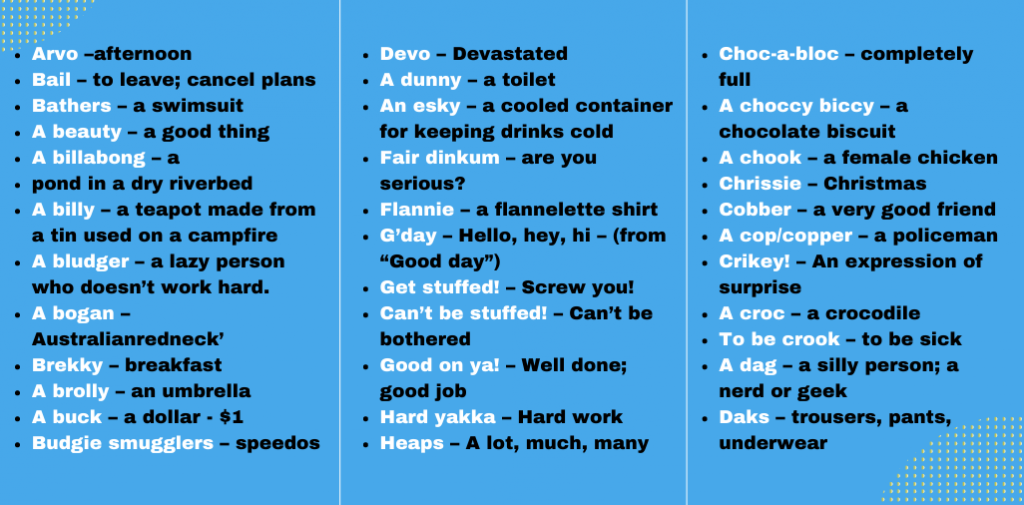

Learn these everyday slang words to help you understand

Extra Australian Slang words…

Fancy a cuppa?

Fancy a cuppa?’ is a question asking if someone desires, if they want, if they would like a cup of tea or a cup of coffee. Right? Fancy a cuppa? Come on in, mate. Fancy a cuppa? I’ll chuck the kettle on and I’ll pour you a cuppa.

So, this is a big part of Australian culture. If you come to Australia and you travel around the place and you meet people, they invite you into their house, they might offer you a cup of tea, and this phrase is going to be heard all over the place, all over the shop. They’re going to say, ‘fancy a cuppa?’.

A response to this might be, ‘yeah, I’d love a cuppa. In fact, I’ll have a cup of tea.’ You know, they’ll often verify. You know, ‘fancy a cuppa?’ ‘Yes.’ ‘Tea or coffee?’ ‘I’ll have coffee.’ ‘I’ll have tea.’ OK. ‘I fancy a cuppa.’ I fancy a cup of coffee, a cup of tea.

In hot water

If you are “in hot water”, quite simply, this is just to be in trouble, right? Or in disgrace. So, if you get into hot water or you’re in hot water, you’re in trouble. A politician might say something and get into hot water, and they have disgraced themselves, right? They’re in a lot of trouble.

Politicians often get into hot water when they say something wrong or do something wrong in public. So, the public will get angry, there’ll be a public backlash. You know, a reaction from the public that’s very negative towards that politician when they’ve ended up in hot water.

Anchors

The Aussie slang “Anchors”. How can we use this? What would this mean? A good expression, an example of an expression using this slang term would be, “throw on the anchors”. And you could use this when you’re driving a car and it effectively just means push the brakes. Right. Put the brakes on, press down on the brake pedal, “throw on the anchors”.

I don’t know where this originates from. I guess the idea is that you are in a boat and you want to slow down, so you just throw the anchors out the back and hope they catch on to something on the seafloor and stop the boat.

Where obviously making an analogy here between boats and cars. So, if you “throw on the anchors”, if you “hit the anchors”, you are hitting the brakes in that car, you’re slowing down.

The Coast is Clear

‘The coast is clear’. So, ‘clear’ can mean easy to perceive or understand or interpret, right? You might hear someone say, ‘is that clear?’ and you might say, ‘yes, it’s very clear’.

It’s crystal clear, right? Meaning it’s incredibly clear. It’s very easy to understand. So, someone’s orders or maybe you go outside and the sky is clear, right? It can mean of a substance transparent or unclouded.

So that you can see through that thing, it is clear, it is transparent. You could have a diamond that is clear, it’s not cloudy or you could have a sky that’s clear, again, not cloudy. The sky is clear of clouds. But here the word ‘clear’ means free of any obstructions or unwanted objects.

So, if the coast is clear, it means that there is no danger of being seen or caught usually doing something you shouldn’t be doing. So, the area is free of someone who might see you or catch you doing something. It’s safe to proceed with your planned action and it’s often used when you’re trying to get away with something.

Contractions Australian Slang

G’day

What’s going on

What’s up

How are you going?

How’s it going?

Catch you later!

See you later!

See you later on!

Aussie English podcast

The content of this blog was a co-creation of the content included in the podcast Aussie English. Designed for intermediate-advanced English students wanting to take English to the next level.

Also for everyone looking to wrap their head around the dialect of English that is Aussie English, Australian Slang and get a fair dose of our culture, history, news and current affairs click here for more information if you enjoy the content.

About Rocket Remit

Rocket Remit is the worlds fastest international money transfer service. Send money instantly to over 40 overseas countries at very competitive rates.

Use the country selector to choose the country and check the rate.

Click here for more information on how to send money using Rocket Remit.